Opinion: Inflation isn't a reason for a hardship withdrawal from your 401k or IRA

Table of Content

- Our mission is to empower women to achieve financial success.

- How much can you take out of your 401(k) to buy a house without penalty?

- Tennessee First-Time Home Buyer Programs and Grants of 2022

- Rocket Mortgage

- There are strict rules for taking money out of a 401(k) or IRA, which you have to master if you need access to your savings

- Russell 2000 Futures

- Find Mortgage Lenders Who Specialize in Helping First-Time Home Buyers

Consider that a $5, k loan will have a payment of $93 per month (at a 6% interest rate) over five years, while a $25,000 loan will have a payment of $483 per month. The latter payment could seriously hinder your ability to pay the mortgage every month, and the bank will take this into consideration when figuring what you qualify for. It’s easy to compare interest rates among lenders and go with the one who offers you the lowest rate..

As mentioned above, this is the less desirable of the two options. Before diving into whether you should use your 401 to buy a house, it’s important to first have a firm grasp on how, exactly, a 401 retirement account works. Once you have a better idea of how much you need to save, it’s time to take advantage of automation.The goal of automation is to take the challenge out of saving. After all, the hardest part is consistently making the choice to put funds away. However, building savings that aren’t automatically taken out of your paycheck is often a bigger challenge.

Our mission is to empower women to achieve financial success.

And if you leave the job while the loan is still active, you have to pay it back immediately or pay tax and a penalty on the remainder. While it’s tempting to use your 401K and dive into homeownership, there are downsides. You’ll face penalties and losses whether you withdraw funds from the account or take out a loan.

On the other hand, USDA loans have income limits and rules on where you can live. In most circumstances, with an early withdrawal, you’ll face a 10% fee on any amount you withdraw. For example, if you withdraw $10,000, you’ll pay a $1,000 fee.

How much can you take out of your 401(k) to buy a house without penalty?

So, you’ve made a resolution to take control of your money this year—that’s amazing. A huge part of building new habits in any area of your life is just deciding you’re going to do it, so you’ve already gotten a big step out of the way... Taking money out of your 401 to buy a house is never, ever a good idea. We already told you that using your 401 to buy a house is a bad idea, right?

But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,548 in 25 years with the same 7% return. Intraday Data provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Enter your email to get connected and notified about our services.

Tennessee First-Time Home Buyer Programs and Grants of 2022

If you have not owned a primary residence in the past two years, you can withdraw up to $10,000 without incurring the 10% early withdrawal penalty (additional amounts have the 10% penalty). Other programs focus on specific demographics who may need assistance in purchasing a house. VA loans allow eligible veterans and service members to get a mortgage loan with no down payment. It also features low-interest rates and flexible mortgage terms. A USDA loan is another type of loan that allows people to pay less for a down payment.

However, keep in mind that you will have to pay yourself back. Unfortunately, there is no 401K first-time home buyer exemption. The pros of using your 401 loan toward a home purchase include convenience and ease. While there are drawbacks to using your 401 for a down payment to buy a house, it can be the right choice for many buyers. Investor Junkie does attempt to take a reasonable and good faith approach to maintain objectivity towards providing referrals that are in the best interest of readers.

For costs related to the purchase of a principal residence or for tuition for the next year, you’d have to produce the bills. In the case of the natural disaster, you’d have to document the event and the costs to repair the damage to your principal residence. Be sure to research all available options before you withdraw any funds from your retirement account. That way, you’ll keep yourself on the path toward enjoying your golden years in your very own home. You can typically borrow up to half of the vested balance of your 401k, or a maximum of $50,000. Most 401k loans must be repaid within five years, although some employers will allow you to repay a 401k loan over 15 years if it’s used for purchasing a home.

I cannot get the original purchase agreement from the owners attorney , my company sponsored 401K partner needs the original to process my hardship loan. What should I do to obtain this paperwork a copy will not work. Forgivable Loans – Similar to a grant, but structured as a second mortgage, these loans do not need to be repaid unless you sell before the agreed-to number of years. You must have a steady income, a credit score of 620 or higher and an acceptable debt-to-income ratio. Don’t risk your retirement nest egg over a stupid debt that will take you years to pay off. Hardship withdrawal is a type of early withdrawal, but you need to prove that you need your 401 money to solve some huge financial problem.

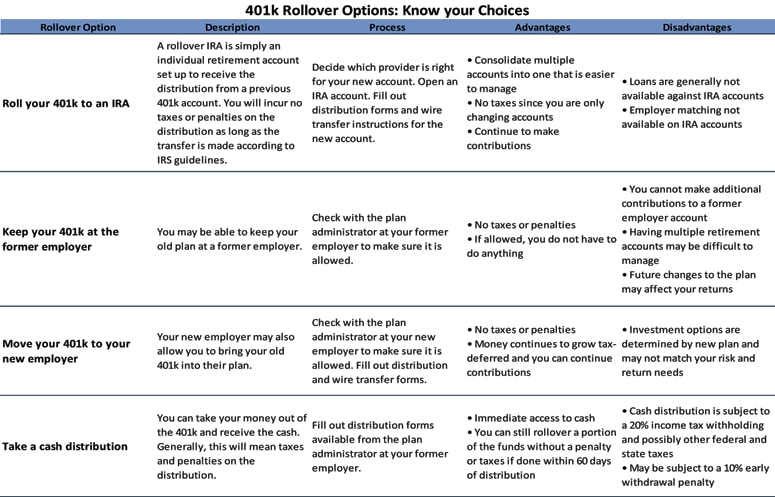

However, you can’t roll over a 401k that’s with an employer for whom you are still working. If you have an old 401k from a former employer, roll that. Since a rollover can take time to process, fill out the necessary paperwork as soon as possible.

In other words, if you withdraw all of your contributions, you can still withdraw another $10,000 and not pay the 10% penalty or taxes on any of it. If I accept that I will need to pay 10% penalty and also income taxes, what is the best way to get my money out of my 401k? Can I roll it over to a Roth IRA then withdraw whatever I need (I don’t want to borrow, but withdraw with no obligation to repay)?

Comments

Post a Comment