Should You Use Your 401k For A Down Payment On A Home?

Table of Content

You may be surprised how this simple step can help you speed towards your savings goal. First thing first, consider how much you actually need to save. But you might be surprised to learn that you don’t need to save as much as you think. Homeownership is an exciting goal that can improve your financial picture. But ultimately, using 401k to buy a house may not be the right move for your financial future.

If they don’t—or if you need more than a $50,000 loan—then you might consider an outright withdrawal from the account. With this strategy, you will incur a 10% penalty on the amount you withdraw from a traditional 401 unless you meet requirements for an exemption. If you need more than $50,000 or your 401 provider does not allow loans, then you will need to make a withdrawal.

Rocket Mortgage

Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely won’t qualify for an exemption. Even if you do, your withdrawal will still be taxed as income. Many first-time home buyers have some type of debt to worry about.

And you can also take out money as a straight withdrawal if you pay the 10% penalty and the tax. Coming up with enough cash to cover the down payment and closing costs is a significant hurdle for many first-time buyers. So it’s natural to consider using the savings in your 401K retirement account. The great thing about 401k loans is that they don’t count towards your debt-to-income ratio.

Withdrawal for Home Purchase

Using a 401k loan to finance your down payment can put you in a more favorable position for financing your mortgage. And, these loans are not reported to the credit bureaus, so they don’t impact your credit score. It can also be beneficial to borrow from your 401k as a first time home buyer in order to make a higher down payment, especially in a competitive housing market.

Along with the fee, you’ll need to pay income tax on whatever you withdraw from your 401. So, if you face a 20% income tax on top of the early withdrawal fee, your $10,000 withdrawal just becomes $7,000. When you take out a 401 loan, you do not incur the early withdrawal penalty, nor do you have to pay income tax on the amount you withdraw. A 401 loan must be repaid with interest, but you don’t have to pay income taxes or tax penalties. You’ll want to find out how much you’re able to borrow, the interest you’ll have to pay, and the repayment period. To avoid paying for mortgage insurance, you must make a downpayment of at least 20% of the purchase price of your home.

Find ways to increase your income instead of using 401k withdrawals for your home purchase

If you lose your job or quit, you will have to repay a 401 loan in full. Any returns generated on investments from your 401 are not taxed. If you withdraw it to put $25,000 towards your home, you’ll experience an immediate loss plus a loss of potential future dividends.

Not all employers offer 401 loans as an option in their retirement plans, though. It’s also important to note that you are still required to repay the loan even if you leave your current job or are laid off. In fact, your repayment period shortens once that happens, and the loan must be repaid in full by the next tax filing date. Homebuyers who borrow from their 401 plans can’t make additional contributions to the accounts or receive matching contributions from their employers while paying off the loan. Depending on how much they were contributing, these home buyers could miss out on years of retirement contributions while they’re paying back the loan. That could take a substantial bite out of their overall retirement savings.

This in-depth article on 401k loans reviews how home buyers can borrow from a 401k for a down payment, why home buyers shouldn’t, and alternatives to consider. Advisory services are offered through SoFi Wealth LLC, an SEC-registered investment adviser. When shopping for a mortgage, you want the best interest rate while avoiding hefty fees.

Because these accounts are meant for retirement, there are penalties for early withdrawal. You are not supposed to make withdrawals until you are 59 ½ (although if you’ve lost or quit your job, you can withdraw funds at 55). Many first-time homebuyers think they have to come up with enough money or take money out of their 401 to cover down payments. The cons of using a 401 for a home purchase down payment include losing out on the investment returns your money would have earned if it stayed in your 401. When it comes to your retirement funds, income after retirement most often comes to mind. But you can also use your 401 toward the down payment to buy a house before you retire.

Talk to your employer’s HR department about what you need to provide. Basically, you will have to prove you do not have any other money and explain why. Your reasons must be able to be proven so the HR department can approve your request to withdraw the money early.

If you’re having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, it shouldn’t be your first choice. There are some factors and drawbacks that you might want to consider before using your 401 to buy a house.

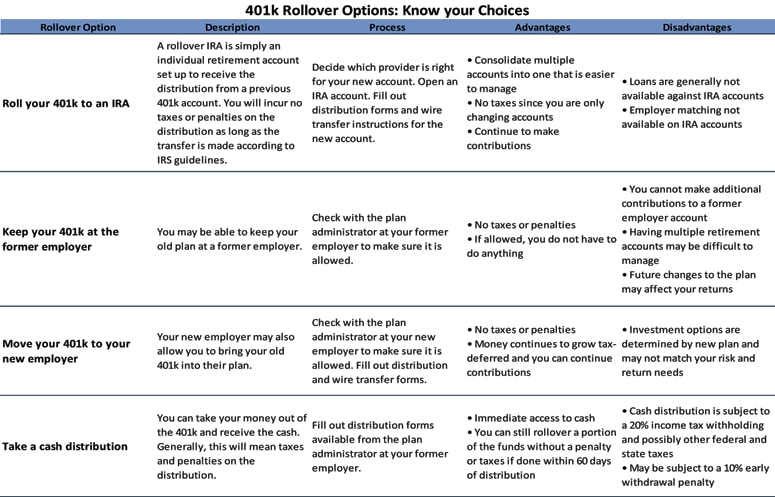

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Only used for qualified acquisition costs, such as closing costs. Making a 401 withdrawal for a home purchase should be a last resort. There are other cheaper alternatives to raise money for a home purchase that do not involve funds deposited in a 401 account. An IRA rollover is a transfer of funds from a retirement account, such as a 401, into an IRA.

Withdrawing from your 401k before you hit retirement age always incurs penalties and fees. There are also different methods for withdrawing from your funding. Traditional wisdom suggests that you put down at least 20% on a home purchase through a conventional loan. However, the plentiful low money-down loans could mean you don’t need to save quite so much.

If you have that money in a 401k, then a 401k loan is a feasible option for avoiding this added expense. The information in this article does not constitute financial planning advice. Please consult a financial planner regarding your specific situation. Please consult a tax advisor regarding your specific situation. Eligibility to programs mentioned are subject to program stipulations, qualifying factors, applicable income and debt-to-income restrictions, and property limits. These materials are not from HUD or FHA and were not approved by HUD or a government agency.

Comments

Post a Comment